Built on Experience, Driven by Expertise, and Focused on the Future of Collections

Avtal was founded by experts who know the challenges of collections inside and out.

With backgrounds at CFPB, TrueAccord, InDebted, LiveVox, Square, and PayPal, we’ve created a debt collection software solution designed not just for today’s demands, but for the next era of digital recovery.

A Team That Knows Your World

At Avtal, we help collection agencies thrive in a digital-first world. Traditional agencies are unmatched in their call center operations and compliance discipline, but they often rely on outdated, manual technology. Digital-first agencies excel at engaging consumers through modern channels like email and text but lack the operational rigor of traditional firms. Avtal brings these strengths together. Our automated software is built specifically for third-party agencies, combining advanced digital engagement with proven call center capabilities to maximize recoveries while maintaining the highest standards of compliance and reliability.

Contact Us

Avtal Mission

We combine our digital expertise with the operational excellence of agencies to create an omnichannel experience that increases liquidation by 50%-75%.

Avtal Vision

We believe that technology should enable the industry to have the highest liquidation rate and margins at any point in its history.

Avtal Advantage

Avtal does not take any upfront costs or monthly minimums. Avtal only earns a percentage of what Avtal helps you collect.

Meet the Avtal Team

Our team brings together deep expertise in collections, compliance, and technology–working to give agencies a simpler, smarter path to recovery.

Joe Gelbard

Founder and President

Joe Gelbard is the Founder and President of Avtal, with 20 years of experience in fintech, SaaS, and specifically digital collections. Joe previously was CRO at InDebted, TrueAccord, and LiveVox. He specializes in scaling companies and building high-performing go-to-market teams, with a track record of driving growth in the collections space. At Avtal, Joe combines his leadership experience with deep expertise in digital collections to deliver innovative solutions that help agencies grow.

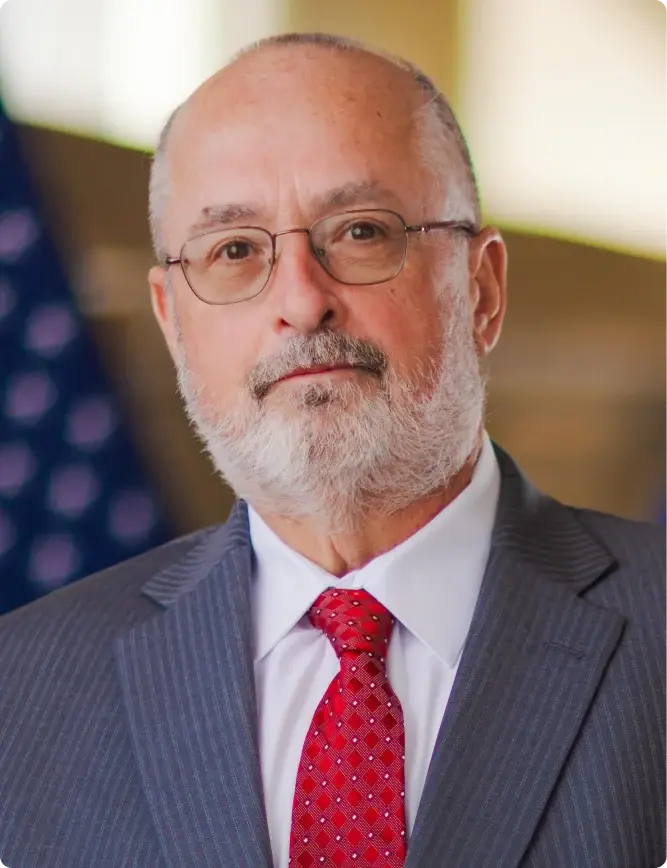

John McNamara

Chief Growth Officer

John McNamara is Chief Growth Officer for Avtal.

Prior to joining Avtal, John was Principal Assistant Director of Markets in the Research, Regulations, and Markets Division of the Consumer Financial Protection Bureau.

At the CFPB, John was a key member of the team that wrote Regulation F, the implementing regulation for the Fair Debt Collection Practices Act.

Prior to joining the CFPB, John was the Chief Marketing Officer for LiveVox and co-founder of Fidelis Recovery Solutions, a debt collector. He has over 30 years of experience in the accounts receivable management (ARM) and call/contact industries, in addition to all phases of collections, recovery and call center operations.

Roger Lai

Chief Customer Officer

Roger Lai is the Chief Customer Officer at Avtal, where he leads client success, implementation, and performance strategy. He partners with agencies to optimize digital outreach, improve deliverability, and drive consumer engagement through Avtal’s self-serve platform — helping clients maximize recoveries and unlock sustainable growth.

Before Avtal, Roger was VP of Product at Grid, a consumer fintech company, where he oversaw underwriting, recoveries, and product strategy. Prior to that, he served as Head of Product for Collections Performance at TrueAccord, where he led initiatives across self-serve payment experiences, offer optimization, omni-channel capabilities, deliverability, machine learning, and experimentation frameworks — directly driving improvements in client scorecards and collections outcomes.

Earlier in his career, Roger built the recoveries function at Block (formerly Square), establishing scalable, data-driven strategies from the ground up.

Khaled Bitar

CEO

Khaled Bitar is the CEO at Avtal. Previously, Khaled served as Co-Founder and CEO of LeftLane Software, a platform that modernizes subprime auto lending by helping seller-financing car dealers digitize their loan operations.

Earlier in his career, Khaled led Supply Operations at ServiceChannel (acquired by Fortive for $1.2B) and spent four years as a consultant at Bain & Company. He holds an MBA from The Wharton School and a BBA from the University of Texas at Austin.

Shahrzad Farshi

Head of Product

Shahrzad Farshi is the Head of Product at Avtal. Prior to Avtal, Shaz led product teams at various early stage fintech SaaS companies like Simur, Fortress Blockchain Technologies and Gentem building and scaling financial risk management tools, infrastructure for trading and settlement solutions, and medical revenue cycle management and collections products. Prior to that, she worked at Amazon building machine learning and experimentation tools for Amazon Supply Chain Optimization Technologies organization. Early in her career, Shaz worked at Abbott Labs building medical technology.

Shahrzad holds an MBA from INSEAD, an MS in Industrial and Systems Engineering from University of Florida and a BA in Mathematics and French from Wellesley College.

Chad Oliver

CTO

Chad Oliver is an experienced technology leader with a proven track record across both Fortune 100 companies and high-growth startups. As CTO of Avtal, he leverages prior leadership roles at Babylon Health and PayPal to guide distributed engineering teams, drive digital transformation, and deliver innovative solutions. His technical expertise spans Java, Golang, JavaScript, and Python, paired with a strong background in architecture, strategy, and execution.

Answers to Frequent Questions About Avtal

Avtal was created to solve a long-standing industry problem: collections that are costly, outdated, and hard to scale. Our goal is to bring agencies a digital-first solution that improves recovery and enhances the consumer experience.

Our platform was built by experts with deep experience in compliance, technology, and collections operations. Unlike generic tools, Avtal combines proven industry knowledge with digital communication and self-service payments designed specifically for agencies.

We work directly with third-party debt collection agencies.

We measure success by the impact on our clients: higher liquidation rates, scalable growth without extra headcount, and profitable recovery across all account types.

Avtal clients can expect responsive support, seamless onboarding, and a partnership built on trust. We work to understand your business needs and align our platform to help you succeed.